Crypto Coins For Next Bull Run Exciting Opportunities Ahead

Exploring crypto coins for next bull run unveils a thrilling landscape where innovative technologies and financial opportunities converge. In the ever-evolving world of cryptocurrency, understanding the nuances of various coins and market trends is crucial for anyone looking to maximize their investment potential during a bull run.

This article delves into the significance of crypto coins within the digital economy, introduces promising coins that are poised for growth, and Artikels strategies to navigate the upcoming market shifts. With insights into historical trends and key indicators, readers will be equipped to make informed decisions as they enter this dynamic market.

Overview of Crypto Coins

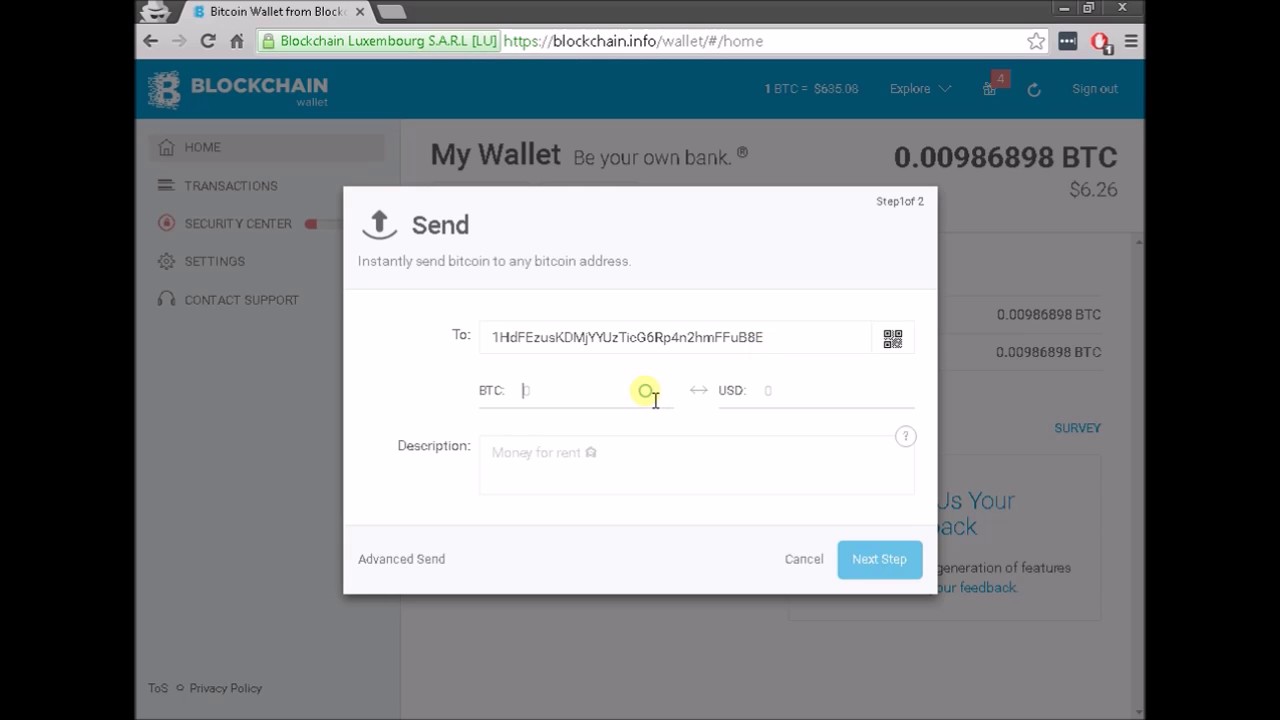

The rise of cryptocurrency has transformed the financial landscape, creating a new digital economy driven by decentralized technologies. Crypto coins are digital assets that leverage blockchain technology to enable secure transactions and store value. Their significance lies in their potential to disrupt traditional financial systems, offering a new way for individuals and businesses to transact without intermediaries. In today's market, there are various types of crypto coins, each serving different purposes.

These include:

- Bitcoin (BTC): The first and most recognized cryptocurrency, primarily used as a store of value.

- Altcoins: A term for cryptocurrencies other than Bitcoin, including Ethereum (ETH), Ripple (XRP), and Litecoin (LTC), each with unique functionalities.

- Stablecoins: Cryptocurrencies pegged to traditional currencies to maintain price stability, such as Tether (USDT) and USD Coin (USDC).

- Utility Tokens: Coins that provide users with access to a product or service within a blockchain ecosystem, such as Binance Coin (BNB).

When comparing popular crypto coins by market capitalization, Bitcoin consistently ranks at the top, followed by Ethereum and other notable altcoins. This hierarchy reflects their adoption and perceived utility in the broader economic context.

Historical Context of Bull Runs

Several factors drive bull runs in the cryptocurrency market. Key contributors include technological advancements, regulatory developments, and macroeconomic conditions that create favorable environments for investment. Historical bull runs, such as those in late 2017 and early 2021, showcased dramatic price increases fueled by heightened media attention and speculative trading.During these bull runs, significant trends emerged in crypto coins, including an influx of new investors and increased trading volumes.

Market sentiment played a crucial role; positive news and endorsements often led to rapid price surges, while negative sentiment could trigger sell-offs.

Key Indicators for the Next Bull Run

Traders and investors must monitor several indicators to predict the onset of a bull run. Key metrics include:

- Market Trends: Analyzing price charts and historical patterns can help identify potential breakout points.

- Trading Volume: Increased trading volume often signifies growing interest and can precede price increases.

- Social Media Sentiment: The buzz on platforms like Twitter, Reddit, and Telegram can reflect public interest and influence price movements.

Critical on-chain metrics, such as wallet addresses growth and transaction volumes, also signal increasing interest in specific crypto coins, providing insights into potential upward trends.

Promising Crypto Coins for Upcoming Bull Run

Several crypto coins show strong potential for the next bull run due to their innovative features and growing adoption. Notable examples include:

- Ethereum (ETH): With its transition to a proof-of-stake model, Ethereum aims to enhance scalability and sustainability.

- Cardano (ADA): Known for its focus on security and scalability, Cardano is gaining traction among developers and investors alike.

- Solana (SOL): With its high throughput capabilities, Solana is attracting attention for decentralized applications and NFTs.

To illustrate their current performance and future projections, a comparison table can be created as follows:

| Crypto Coin | Current Market Cap | Future Projections |

|---|---|---|

| Ethereum (ETH) | $200 billion | Estimated growth of 50% in the next year |

| Cardano (ADA) | $50 billion | Projected increase of 40% within 12 months |

| Solana (SOL) | $30 billion | Potential rise of 60% due to increased adoption |

Investment Strategies for the Bull Run

Developing a comprehensive investment strategy is essential for capitalizing on a bull run. Key components include:

- Risk Management: Implementing stop-loss orders and diversifying investments to mitigate losses during downturns.

- Portfolio Allocation: Allocating funds across a range of crypto coins to minimize risk and maximize potential returns.

- Long-term Holding: Focusing on quality projects with strong fundamentals while avoiding short-term volatility.

A well-balanced portfolio should consist of established coins like Bitcoin and Ethereum, alongside promising altcoins to capture growth opportunities.

Community and Market Influence

Community engagement and developer activity significantly impact the success of crypto coins. Active communities can drive adoption and create positive market sentiment. For instance, projects like Chainlink and Tezos have thrived due to robust community support and contributions from developers.Examples of community-driven projects include:

- Ethereum: Backed by a vibrant developer ecosystem focused on smart contract innovations.

- Cardano: Community-led initiatives have enhanced its credibility and user base.

Influential figures, such as Vitalik Buterin and Charles Hoskinson, have made substantial contributions to the crypto space, shaping the future of blockchain technology and its applications.

Future Trends in Cryptocurrency

Emerging trends in the cryptocurrency market could have significant implications for the next bull run. These trends include:

- Regulatory Changes: As governments establish clearer guidelines, mainstream adoption may increase, impacting the value of crypto coins.

- Technological Advancements: Innovations such as layer-2 solutions and interchain operability are set to enhance usability and scalability.

The interplay between regulatory developments and technological growth will likely stimulate interest, attracting new investors and further legitimizing the crypto market.

Final Summary

In conclusion, the potential for significant gains in the cryptocurrency market during the next bull run is palpable. By staying informed about market indicators, investing in the right coins, and employing sound strategies, investors can enhance their chances of success. As the landscape evolves, engaging with the community and keeping an eye on emerging trends will be essential for those ready to seize the moment.

FAQ Overview

What are crypto coins?

Crypto coins are digital currencies that utilize blockchain technology to secure transactions and control the creation of new units, playing a vital role in the digital economy.

How do I identify promising crypto coins?

Look for coins with strong market capitalization, unique use cases, active community engagement, and positive trends in trading volume and market sentiment.

What factors drive a bull run in the crypto market?

Key factors include positive market sentiment, increased trading volume, regulatory clarity, and technological advancements that spur investor interest.

How should I manage risks during a bull run?

Implementing diversification strategies, setting stop-loss orders, and regularly reviewing your portfolio can help manage risks effectively.

Why is community engagement important for crypto coins?

Community engagement can significantly influence a coin's success, as active participation often leads to increased interest, support for development, and enhanced market perception.